How to Qualify Ford F-150 for Section 179 in Colorado 2024

Table of Contents

Key Highlights

- Section 179 allows businesses to deduct a significant portion of the purchase price of qualifying vehicles, including the Ford F-150, in the year of purchase.

- To qualify, the vehicle’s Gross Vehicle Weight Rating (GVWR) must exceed 6,000 pounds, and it needs to be used for business purposes at least 50% of the time.

- Colorado follows the same Section 179 regulations as the federal government, so businesses in Colorado can benefit from this tax break.

- Maintaining proper documentation of the vehicle’s purchase and business use is essential for claiming Section 179.

- Consulting a qualified tax professional is recommended to maximize deductions and ensure compliance with IRS guidelines.

Introduction

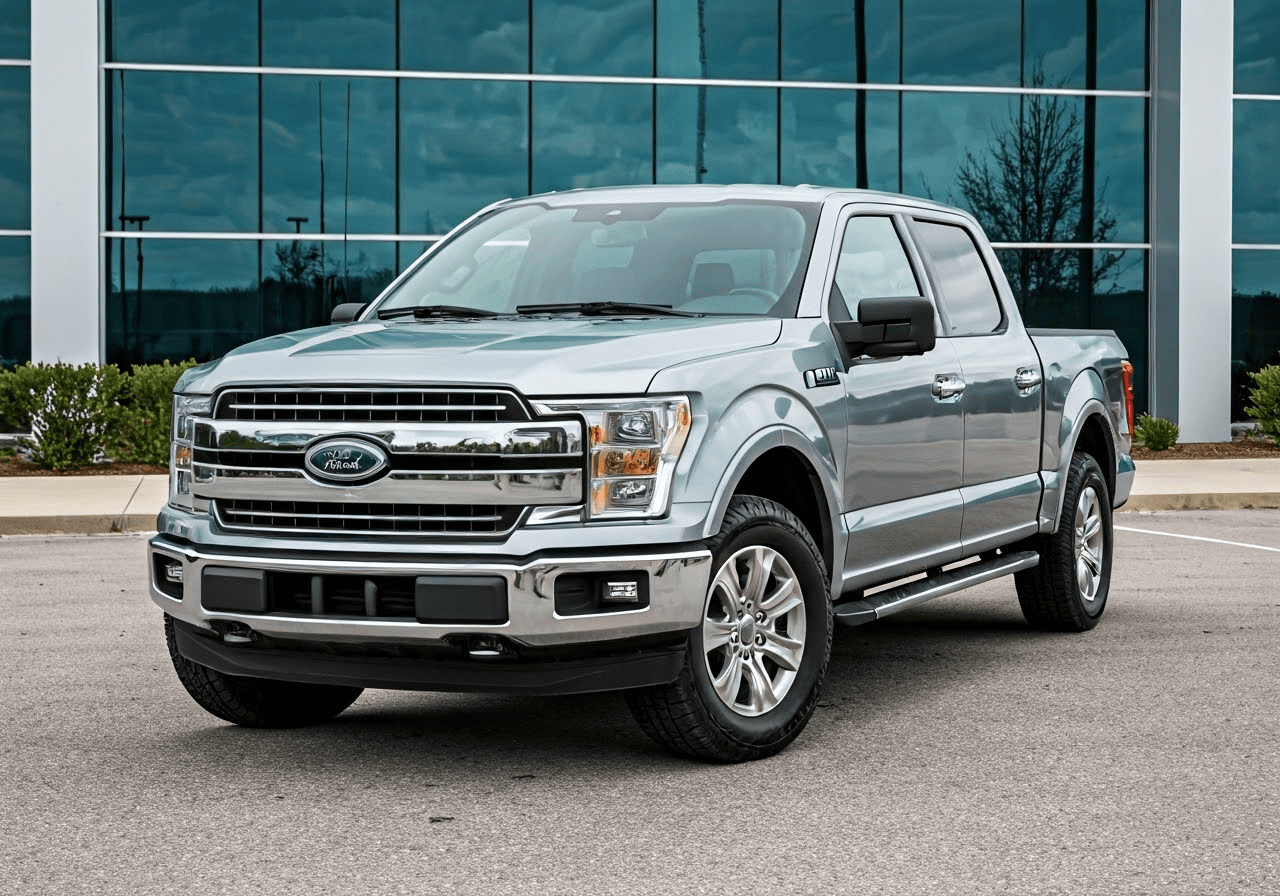

Attention all business owners in Colorado! Are you thinking about adding a strong Ford F-series truck to your fleet? If yes, you are in the right place! The Section 179 tax break can help you save a lot of money. This blog will help you understand how to qualify your Ford F-150 for Section 179 in Colorado for the 2024 tax year. We will explain the eligibility rules, detail the steps you need to take, and answer some common questions. Let’s dive in!

Understanding Section 179

Imagine taking a big part of a new vehicle’s cost off your taxes right away. This is what Section 179 of the IRS tax code lets you do. It can really help businesses, especially small and medium ones.

Section 179 encourages companies to buy new equipment and vehicles to improve their work. By letting businesses write off a large portion of the purchase price in the first year, they can save money. This gives them more funds for other investments and daily expenses.

The Basics of Section 179 Deduction

Section 179 is a tax deduction meant for business owners. It lets you deduct a large sum, even the whole purchase price, right in the year you start using the asset for your business. This is different from the usual way of reducing the asset’s value over time.

This deduction can apply to many types of business equipment and vehicles, not just Ford F-150s. Yet, there are certain rules a vehicle must meet to qualify for this deduction, which we will look at later.

The best part of Section 179 is that it gives quick tax help. This can help your cash flow and lower your overall tax costs.

Importance for Small and Medium Businesses in the US

For small business owners, saving money is just like earning it. Section 179 is an important tax break when buying new assets. It helps reduce the financial load from big purchases. This allows business owners to use that money for other important investments.

Being able to deduct a large part of the purchase price right away is very helpful for businesses with limited budgets. This quick deduction leads to real savings. It can even mean the difference between growing or delaying growth plans.

In summary, Section 179 helps small and medium businesses make smart investments. They can grow without worrying too much about high tax costs.

Eligibility Criteria for Vehicles under Section 179

It is important to know if your vehicle qualifies for Section 179 before you celebrate possible tax savings. The great news is that many Ford F-150 models meet the requirements easily. This makes them good choices for this deduction.

Two main factors decide if a vehicle is eligible: weight and usage. Let’s look at each requirement so you can understand what you need to qualify your Ford F-150.

Weight Requirement for Qualification

One of the first challenges for getting your vehicle approved under Section 179 is the weight requirement. Not all vehicles are seen the same way by the IRS! The rules separate different types of vehicles. This includes ones meant mainly for people and those made for heavier things.

To be eligible for Section 179, your Ford F-150 needs a Gross Vehicle Weight Rating (GVWR) over 6,000 pounds. This rating shows the highest weight allowed for the vehicle, including what it can carry. In other terms, vehicles that can carry more weight usually qualify.

The good news is that many Ford F-150 models, especially the popular XL, XLT, and Lariat versions, have a GVWR much higher than 6,000 pounds. This makes them great options for the Section 179 deduction if they meet the usage rules, which we will talk about next.

Business Use Percentage Necessary

Meeting the weight requirement is just the first step. The IRS also checks how much you use your vehicle for business compared to personal use during the tax year. To get the full Section 179 deduction, your Ford F-150 must be used mainly for business, which means over 50% of the time.

This is why you need to track your mileage closely! Keep a detailed logbook or, even better, use a mileage tracking app. This will help you record your business trips, errands, and any other driving related to your business.

If your business use goes below 50%, you can still claim a partial deduction based on how much you used it for business. But if you stay above 50%, you will get the most benefits from Section 179.

Step-by-Step Guide to Qualify Your Ford F-150

Now that you understand the eligibility rules, let’s go over the steps to claim the Section 179 deduction for your Ford F-150. This guide makes it easy so you can get all the important details to make the most of your tax savings.

Keep in mind that keeping good records is very important during this process. Now, let’s look at the steps!

Step 1: Assessing Your Vehicle’s Eligibility

Before starting any paperwork, it is important to make sure your Ford F-150 meets the rules for Section 179 eligibility. As we talked about earlier, the weight requirement and the business use percentage are the main factors.

First, find your vehicle’s GVWR on the sticker inside the driver’s side door. It needs to be over 6,000 pounds. Next, think about how you use your vehicle. If you mostly use your Ford F-150 for business—like transporting equipment, moving materials, or meeting clients—you should be in a good position.

Also, if more than 50% of your use is for business, you can take the full deduction. It’s important to keep good records of your mileage during the year, especially if you also use the truck for personal trips.

Step 2: Documentation and Records Keeping

Meticulous record-keeping is not just a good habit; it is very important for claiming the Section 179 deduction. The IRS needs strong proof to back your claims. Well-organized documents will protect you from possible audits.

First, gather all documents related to your Ford F-150 purchase. This includes the sales contract, financing agreement (if needed), and any other important papers. These documents show the purchase date and cost. These are key details for figuring out your deduction.

Also, it is vital to keep a detailed mileage log during the year. This log should have the date, purpose of each trip (business or personal), starting and ending mileage, and names of clients or business destinations.

Step 3: Filing for Section 179 Deduction

With your documents ready, it’s time to turn them into tax savings. To get the Section 179 deduction, you must file IRS Form 4562, Depreciation and Amortization, along with your tax return.

Form 4562 might seem hard, but it is actually simple, especially with the info you gathered. You will need to fill in details about the vehicle, the purchase price, when you started using it for your business, and the depreciation amount based on how much you use it for business.

Think about getting help from a good tax professional or accountant. They can help you understand the forms better. This way, you can get the most out of your deductions without any issues with the IRS.

Frequently Asked Questions

What is the Maximum Deduction for a Ford F-150 under Section 179?

For the 2024 tax year, you can deduct up to \$28,900 for vehicles over 6,000 pounds GVWR, such as many Ford F-150 models. But remember, this deduction cannot be more than your business’s taxable income for the year.

Conclusion

In conclusion, it is important to understand Section 179 and how it affects your Ford F-150 in Colorado for 2024. This knowledge is useful for small and medium businesses that want to take advantage of tax deductions. To make sure your vehicle qualifies, meet the eligibility rules and follow the guide step by step. Good paperwork and compliance are key to successfully claiming your deduction. Keep an eye on the weight limits and the business use percentage to get the most benefits. Spending time to learn these details can lead to big tax savings for your business. If you have more questions about Section 179 deductions for your Ford F-150, check out our Frequently Asked Questions section for more information.