Table of Contents

Key Highlights

- Businesses can leverage the Section 179 deduction to potentially reduce their tax liability when they purchase a new Cadillac Lyriq.

- The Cadillac Lyriq, being a qualifying electric vehicle, can open doors to substantial tax savings for businesses.

- Leveraging Section 179 can lead to a reduced total cost of ownership for the Cadillac Lyriq, making it a more financially appealing investment.

- It is crucial for businesses to consult with tax professionals to ensure they meet all the eligibility criteria and maximize their tax savings.

- Businesses must explore potential state and federal incentives for electric vehicles for which they may be eligible, alongside Section 179.

Introduction

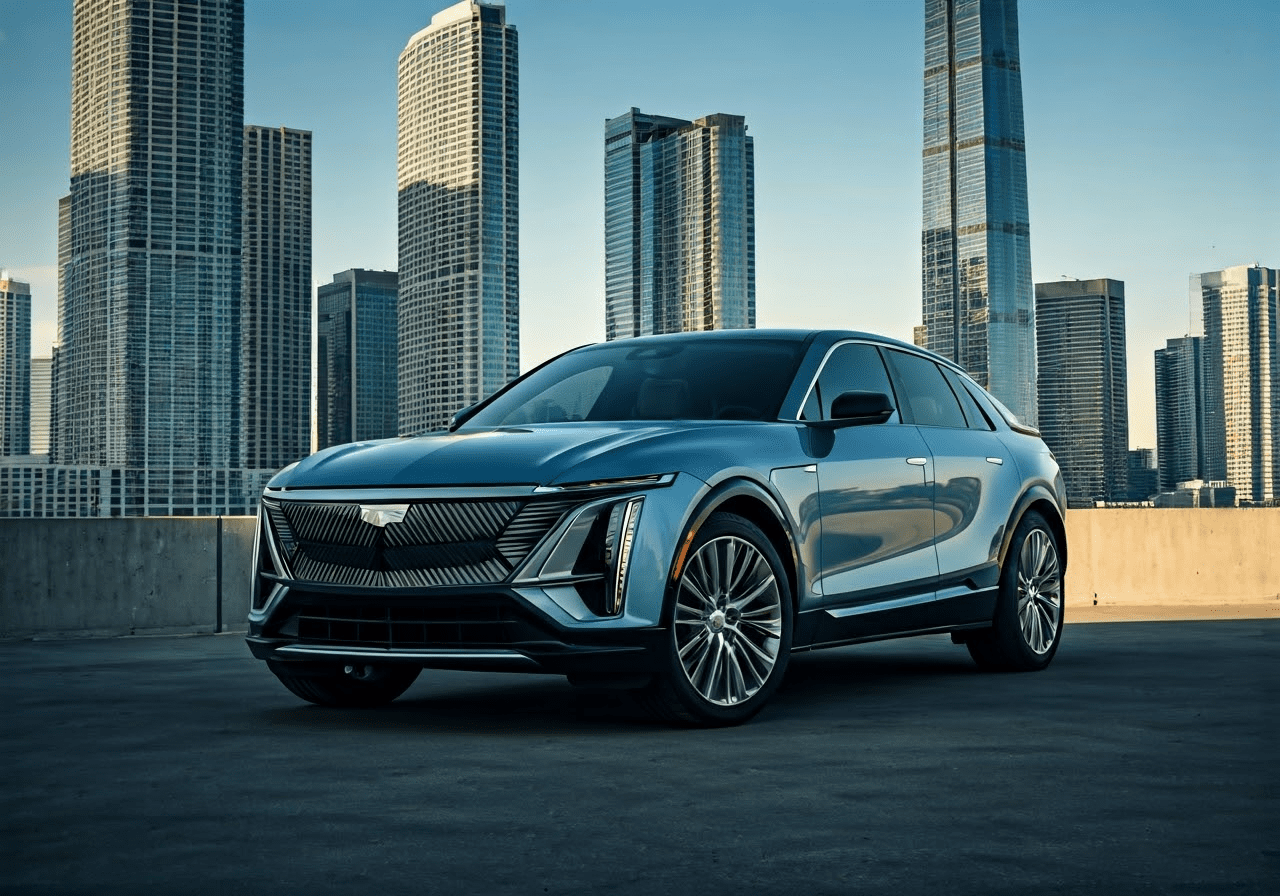

Stepping into luxury electric vehicles is now more appealing for businesses because of the Section 179 tax deduction. This deduction helps eligible companies lower their taxes when they buy a new vehicle for work. It works perfectly with the beautiful Cadillac Lyriq. Picture yourself driving this amazing car right out of the showroom and into big tax savings. Let’s look at how you can make the most of these benefits with the Cadillac Lyriq.

Understanding Section 179 Deduction

The Section 179 deduction is a great benefit for businesses that want to buy new equipment, like vehicles, while staying financially healthy. It lets eligible businesses deduct a big part of the purchase price of qualifying assets, such as the Cadillac Lyriq, from their taxable income in the year they buy it.

This means they can save money on taxes right away, which helps add more funds back into their business. In simple terms, Section 179 turns a large expense into something easier to manage. This makes it simpler for businesses to get the items they need to succeed.

Overview of Section 179 and Its Impact on Businesses

The Section 179 deduction is part of the U.S. tax code. It aims to boost business growth and investment. This deduction helps businesses avoid the old method of depreciation. Instead of spreading the deduction over several years, they can deduct expenses right away.

This deduction affects how much tax a business pays. By reducing the purchase price significantly in the same year, businesses can lower their tax bill. This gives them extra cash to spend on other investments or daily expenses.

For businesses thinking about buying an electric vehicle (EV), the Section 179 deduction can be very important. It makes buying newer and often pricier vehicles, like the Cadillac Lyriq, a smart choice financially.

The 2023 Deduction and Spending Limits

In 2023, the Section 179 deduction lets businesses deduct up to $1,080,000 for eligible equipment buys. This means businesses can write off a large part, or even all, of their Cadillac Lyriq cost.

But, it is essential to know the spending limits tied to this deduction. When a company’s total equipment purchases go above $2,700,000 in 2023, the deduction starts to go down dollar for dollar.

So, understanding these limits is key for businesses. They need to plan their purchases wisely to make the most of the Section 179 deduction.

How the Cadillac Lyriq Qualifies for Section 179

The Cadillac Lyriq is an electric SUV that qualifies for Section 179. It meets the rules for being used in business, which helps it qualify for this important tax benefit.

By checking these boxes, the Cadillac Lyriq gives businesses a great chance to support sustainability and improve their finances.

Criteria Making Cadillac Lyriq Eligible for Tax Savings

The Cadillac Lyriq can help you save on taxes if you meet certain rules from Section 179. First, you need to use the vehicle mainly for business, which means over 50% of the time. This includes client meetings, site visits, or work commutes that are related to your job.

Second, you must buy the Cadillac Lyriq and start using it within the same tax year to get the tax break. This means you need to have the car ready for business use by December 31st of that tax year.

Lastly, make sure to buy and title the vehicle in your business’s name, not your personal name. If you follow these steps, your business can use Section 179 to lower its taxes, making the most of your investment in the Cadillac Lyriq.

Comparing Cadillac Lyriq with Other Vehicles Under Section 179

While several vehicles qualify for the Section 179 deduction, the Cadillac Lyriq stands out due to its luxurious features, impressive performance, and contribution to a greener footprint. However, comparing the Lyriq with other eligible vehicles can provide a more comprehensive understanding of its potential tax benefits.

Let’s consider a simplified comparison:

|

Vehicle Type |

Potential Deductible Amount in 2023 |

|

Cadillac Lyriq |

Up to $1,080,000 |

|

SUVs over 6,000 lbs. but under 14,000 lbs. |

Up to $25,000 |

|

Other Passenger Vehicles |

Up to $11,160 |

As evident from the table, the Cadillac Lyriq, potentially having a much higher deductible amount, makes a strong case for businesses seeking to maximize their tax savings under Section 179.

Conclusion

In summary, knowing how to use the Section 179 Deduction can help your business save on taxes. The Cadillac Lyriq is one great vehicle that qualifies for this deduction. It brings financial benefits for businesses that want to invest in electric vehicles. By using this tax option, you can help the environment and improve your profits too. Think about the long-term savings and the positive impact on nature offered by using the Section 179 for the Cadillac Lyriq. If you need more help or have questions on how to maximize your tax savings, reach out to our experts for personal advice.

Frequently Asked Questions

Can I Claim Section 179 Deduction for a Fully Electric Vehicle Like the Cadillac Lyriq?

Yes, you can definitely claim the Section 179 tax deduction for the Cadillac Lyriq. This is possible if it is used mainly for business and meets other criteria. By doing this, you may save money on your taxes for your business.

What Are the Specific Benefits of Section 179 for Electric Vehicles?

Section 179 provides big advantages for buying electric vehicles. It can help cover the higher initial costs that come with these cars, unlike regular vehicles. This tax deduction allows businesses to adopt green technologies without putting too much pressure on their finances.

How Does the Deduction Affect the Total Cost of Ownership for the Cadillac Lyriq?

The Section 179 deduction can help lower the total cost of owning a Cadillac Lyriq. It does this by cutting down the initial investment and offering tax savings. You can then use these savings to invest back into your business.

Are There Limitations to the Section 179 Deduction for Luxury Electric Vehicles?

Yes, there are some limits. Businesses have to follow the yearly limits on deductions and spending shown in Section 179. It is a good idea to talk to a tax expert. They can help you follow the rules and get the most deduction for luxury electric vehicles.

Can Businesses Combine Section 179 with Other Incentives for the Cadillac Lyriq?

Sure! Businesses should look into more options besides Section 179. They can check for other federal or state incentives. This includes tax credits or rebates for electric vehicles. Using these incentives together can help increase tax savings and provide more benefits overall.